I've been thinking about ships, profitability and cargo recently. The Free Trader and to a lesser extent the Far Trader are practically default ship for the game, but their profitability, or sustainability is marginal. Large ships, in theory, have better economics due to the better mass ratio larger drives, the better ship size to bridge ratio for the minimum 20 ton bridge requirement and better ratio of ship size to crew requirements. A merchant will need one extra crew, a Navigator, but still comes out ahead on usable space/crew space.

A free trader will lose 10% of it's mass to the bridge. 7.5% to it's drives, and 10% to crew cabins. And 15%to fuel. A 400 ton merchant will lose 5% to the bridge, 6.25% to drives, 5% to crew cabins, and 12.5% to fuel. Or 42.5% of the ship's mass taken up by systems, vs %30 for a 400 ton merchant.

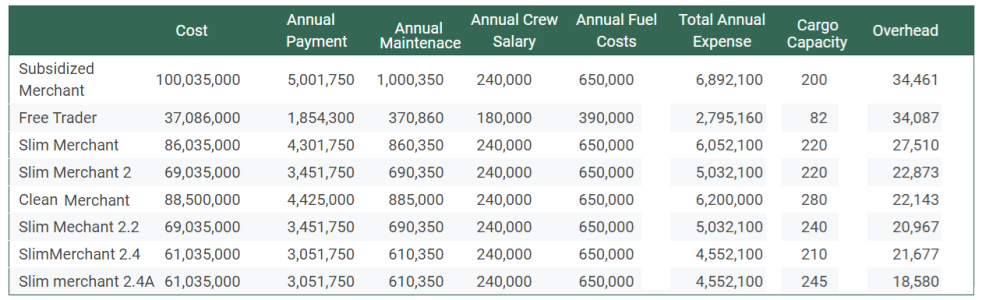

As you can see the Merchant has a substantial advantage over the Free Trader. However when you consider the options available in the core book, we have the Free Trader @ 37.08MCR and the Subsidized Merchant @ 100.035 MCR so your Morgage Payment will be 154,500 cr for the Trader vs 416,813 cr for the Merchant. If we include extra money that has to be set aside for year maintenance and down time, and include crew expenses the yearly operating cost become 2,794,000 for the Free trader, and 6,892,106 for a Merchant. Considering the Free trader has 82 Tons of cargo space vs 200 for the Merchant the cost are: 34,461 cr/ton of cargo for the merchant and 34,087 cr/ ton of cargo for the Free Trader. A virtual tie. But the Merchant in the book has a very key flaw, It's carrying a 20 ton launch, which adds 14 Mcr to the price. Removing the launch, and using that space give us a ship that costs 86.035 MCR with 220 tons cargo, 15 tons are lost to "space reserved for dive upgrades" and it's payment is reduced to 358,480 cr. This "Slim Merchant" would have an annual expense of, 6,052,100 Mcr or 27,510 cr/usable ton. A decent improvement over the Free Trader.

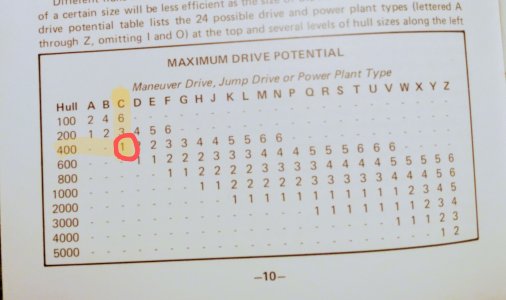

But there's still room for improvement, It's carrying C/C/C drives which add another 17 Mcr to the price, dropping these to B/B/B drops the ship's cost to 69.035 Mcr, no space is gained as this remains part of the Engineering section, but the economics improve. The payment is 287,625 cr, the annual expenses are 5,031,800 and the expense per usable ton is 22,837 cr/ton. Which is much more manageable than the 34,087 for the Free Trader. But there's still 25 tons wasted to "space reserved to drives" So if you go forego the Standard Hull you can gain 25 tons at a cost of 24 Mcr, probably not a great deal, but.....

The "Clean Trader" would have "B/B/B" drives, A comp 1, 5 staterooms for crew, 279 Tons usable space, and cost 86.5 Mcr. Additional fittings for passengers could be added to this. It annual cost would be almost identical to the "Slim merchant 1" which is the subsidized merchant without the launch. 368,750cr/month 6,2000,000/year or 22,143 cr/usable ton. very slightly better than the STD merchant. Fitting it out with passenger cabins, low berth and streamlining would change the economic some, but it's still better than a Free Trader. And very slightly better than the "Slim merchant 1"

But I've still got one more scheme to try, combining standard hulls. If I can put together 2 standard 200 ton hulls I get a hull that is 400 tons costs 16 Mcr, offers 370 tons of usable space, and 30 tons reserved for drive. The cost is the same as the standard 400 ton hull, but it gains 20 tons usable space. Using this approach, you could build a ship for the same cost as the Subsidized merchant, but with 20 tons more space. 30 tons for Engines vs 50 Tons for engines. At that point you are looking at a 400 ton streamlined ship with B/B/B drives, Comp 1, 13 staterooms, 9 Low berths, 2 hard points, 2 tons for fire control, 240 tons of cargo space, basically a Subsidized without the launch, 30 tons reserved for drives instead of 50. The cost should be identical to the Subsidized Merchant minus the launch and downgraded to B/B/B drives. The cost would be 69.035 Mcr, the payment would be 287,625 Mcr, the annual expense would be 5,031,800, and the overhead is 20,965 cr/ ton of cargo.

You could do the same trick, putting 4 * 100 ton hulls together, but then you'd be losing 60 tons to engineering, rather than 30. You would end up with a 400 ton streamlined ship with B/B/B drives, Comp 1, 13 staterooms, 9 Low berths, 2 hard points, 2 tons for fire control, 210 tons of cargo space, basically a Subsidized without the launch, 60 tons reserved for drives instead of 50. The cost should be identical to the Subsidized Merchant minus the launch and downgraded to B/B/B drives, minus 8 MCr for 4*STD 100 tons hulls vs 1 * STD 400 Hull. The cost would be 61.035 Mcr, the payment would be 254,313 Cr, the annual expense would be 4,552,100 Cr and the overhead is 21,667 cr/ ton of cargo. The space lost to the Engineering/drive section really hurts this build.

Assuming you could reclaim the space reserved for engines, you could have a You would end up with a 400 ton streamlined ship with B/B/B drives, Comp 1, 13 staterooms, 9 Low berths, 2 hard points, 2 tons for fire control, 245 tons of cargo space, basically a Subsidized without the launch, and 25 tons used for drives instead of 50. The cost should be identical to the previous example, @ 61.035 Mcr, the payment& annual expense would be still be 254,313 Cr/month and 4,552,100 Cr/Year but the overhead would be 18,580 cr/ ton of cargo.

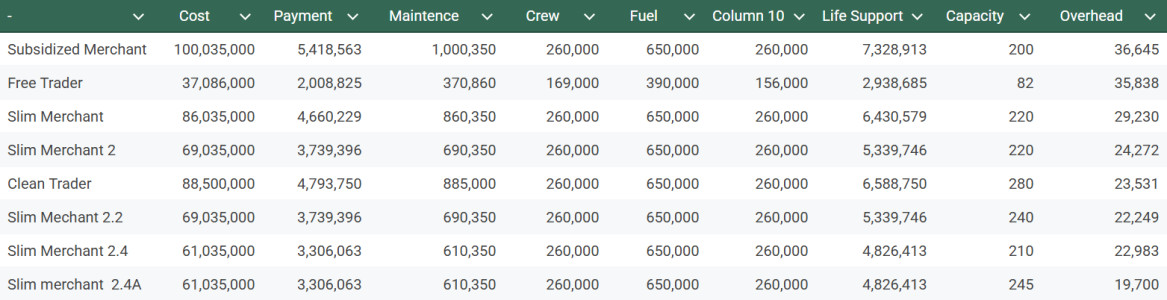

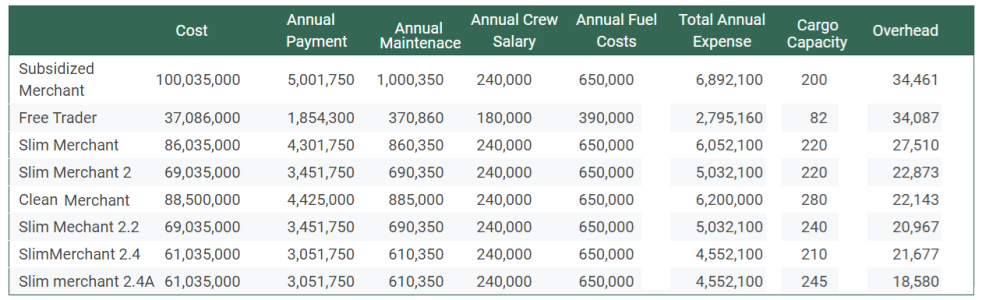

Comparing the ships you end up with something like this:

With the "Slim Merchant 2.2" being 2 * 200 hulls, the "Slim Merchant 2.4 being 4 * 100 hulls, and the "Slim Merchant 2.4 A" having the 35 tons of unused space in the engineering section used for Fuel Tankage. Which I think is justifiy-able.

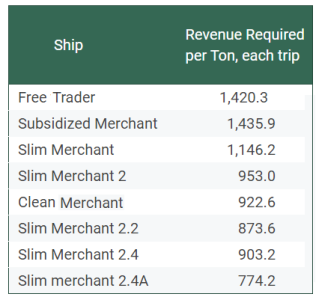

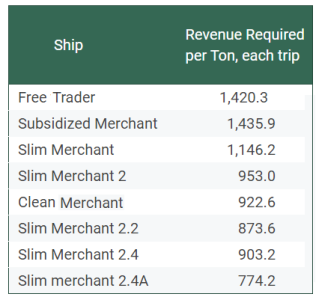

And the per trip economics look something like this:

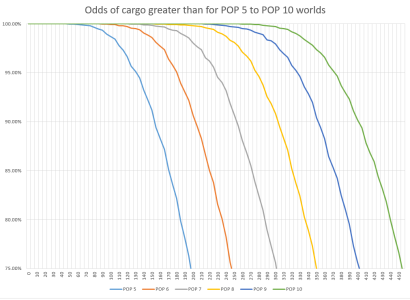

So the Free trader needs 1,420.3 Cr each trip for each ton of cargo space to make a profit, vs 774.2 Cr per ton of cargo space for the revamped merchant. There is still room to improve, for example buying unrefined fuel and refining it on ship, and this doesn't consider passengers. But pretty much any improvement you can make on a Free Trader you can make on a Merchant.

A free trader will lose 10% of it's mass to the bridge. 7.5% to it's drives, and 10% to crew cabins. And 15%to fuel. A 400 ton merchant will lose 5% to the bridge, 6.25% to drives, 5% to crew cabins, and 12.5% to fuel. Or 42.5% of the ship's mass taken up by systems, vs %30 for a 400 ton merchant.

| Bridge | Crew | Drives | Fuel | Remaining Space | Percent Usable | |

| Free Trader | 20 Tons | 20 Tons | 15 Tons | 30 Tons | 115 Tons | 57.5% |

| Merchant | 20 Tons | 25 Tons | 25 Tons | 50 Tons | 280 Tons | 70% |

As you can see the Merchant has a substantial advantage over the Free Trader. However when you consider the options available in the core book, we have the Free Trader @ 37.08MCR and the Subsidized Merchant @ 100.035 MCR so your Morgage Payment will be 154,500 cr for the Trader vs 416,813 cr for the Merchant. If we include extra money that has to be set aside for year maintenance and down time, and include crew expenses the yearly operating cost become 2,794,000 for the Free trader, and 6,892,106 for a Merchant. Considering the Free trader has 82 Tons of cargo space vs 200 for the Merchant the cost are: 34,461 cr/ton of cargo for the merchant and 34,087 cr/ ton of cargo for the Free Trader. A virtual tie. But the Merchant in the book has a very key flaw, It's carrying a 20 ton launch, which adds 14 Mcr to the price. Removing the launch, and using that space give us a ship that costs 86.035 MCR with 220 tons cargo, 15 tons are lost to "space reserved for dive upgrades" and it's payment is reduced to 358,480 cr. This "Slim Merchant" would have an annual expense of, 6,052,100 Mcr or 27,510 cr/usable ton. A decent improvement over the Free Trader.

But there's still room for improvement, It's carrying C/C/C drives which add another 17 Mcr to the price, dropping these to B/B/B drops the ship's cost to 69.035 Mcr, no space is gained as this remains part of the Engineering section, but the economics improve. The payment is 287,625 cr, the annual expenses are 5,031,800 and the expense per usable ton is 22,837 cr/ton. Which is much more manageable than the 34,087 for the Free Trader. But there's still 25 tons wasted to "space reserved to drives" So if you go forego the Standard Hull you can gain 25 tons at a cost of 24 Mcr, probably not a great deal, but.....

The "Clean Trader" would have "B/B/B" drives, A comp 1, 5 staterooms for crew, 279 Tons usable space, and cost 86.5 Mcr. Additional fittings for passengers could be added to this. It annual cost would be almost identical to the "Slim merchant 1" which is the subsidized merchant without the launch. 368,750cr/month 6,2000,000/year or 22,143 cr/usable ton. very slightly better than the STD merchant. Fitting it out with passenger cabins, low berth and streamlining would change the economic some, but it's still better than a Free Trader. And very slightly better than the "Slim merchant 1"

But I've still got one more scheme to try, combining standard hulls. If I can put together 2 standard 200 ton hulls I get a hull that is 400 tons costs 16 Mcr, offers 370 tons of usable space, and 30 tons reserved for drive. The cost is the same as the standard 400 ton hull, but it gains 20 tons usable space. Using this approach, you could build a ship for the same cost as the Subsidized merchant, but with 20 tons more space. 30 tons for Engines vs 50 Tons for engines. At that point you are looking at a 400 ton streamlined ship with B/B/B drives, Comp 1, 13 staterooms, 9 Low berths, 2 hard points, 2 tons for fire control, 240 tons of cargo space, basically a Subsidized without the launch, 30 tons reserved for drives instead of 50. The cost should be identical to the Subsidized Merchant minus the launch and downgraded to B/B/B drives. The cost would be 69.035 Mcr, the payment would be 287,625 Mcr, the annual expense would be 5,031,800, and the overhead is 20,965 cr/ ton of cargo.

You could do the same trick, putting 4 * 100 ton hulls together, but then you'd be losing 60 tons to engineering, rather than 30. You would end up with a 400 ton streamlined ship with B/B/B drives, Comp 1, 13 staterooms, 9 Low berths, 2 hard points, 2 tons for fire control, 210 tons of cargo space, basically a Subsidized without the launch, 60 tons reserved for drives instead of 50. The cost should be identical to the Subsidized Merchant minus the launch and downgraded to B/B/B drives, minus 8 MCr for 4*STD 100 tons hulls vs 1 * STD 400 Hull. The cost would be 61.035 Mcr, the payment would be 254,313 Cr, the annual expense would be 4,552,100 Cr and the overhead is 21,667 cr/ ton of cargo. The space lost to the Engineering/drive section really hurts this build.

Assuming you could reclaim the space reserved for engines, you could have a You would end up with a 400 ton streamlined ship with B/B/B drives, Comp 1, 13 staterooms, 9 Low berths, 2 hard points, 2 tons for fire control, 245 tons of cargo space, basically a Subsidized without the launch, and 25 tons used for drives instead of 50. The cost should be identical to the previous example, @ 61.035 Mcr, the payment& annual expense would be still be 254,313 Cr/month and 4,552,100 Cr/Year but the overhead would be 18,580 cr/ ton of cargo.

Comparing the ships you end up with something like this:

With the "Slim Merchant 2.2" being 2 * 200 hulls, the "Slim Merchant 2.4 being 4 * 100 hulls, and the "Slim Merchant 2.4 A" having the 35 tons of unused space in the engineering section used for Fuel Tankage. Which I think is justifiy-able.

And the per trip economics look something like this:

So the Free trader needs 1,420.3 Cr each trip for each ton of cargo space to make a profit, vs 774.2 Cr per ton of cargo space for the revamped merchant. There is still room to improve, for example buying unrefined fuel and refining it on ship, and this doesn't consider passengers. But pretty much any improvement you can make on a Free Trader you can make on a Merchant.

Last edited: